Residential Properties:

Search for high quality residential properties available to buy and rent, including houses, apartments, townhouses and land at our award winning communities in Sydney, Melbourne, Brisbane and Perth.

Since we started out in 1972, Mirvac has become one of Australia’s most trusted residential property developers, creating high-quality homes that enable people to live great lives.

Our apartments and masterplanned communities are carefully designed with our customers in mind, and we keep sustainability and social connection at the heart of every development.

.png)

The Right Place

Property How To

Video: Living Room Styling with Steve Cordony

Mirvac has collaborated with Steve Cordony to show you how to make your home your haven.

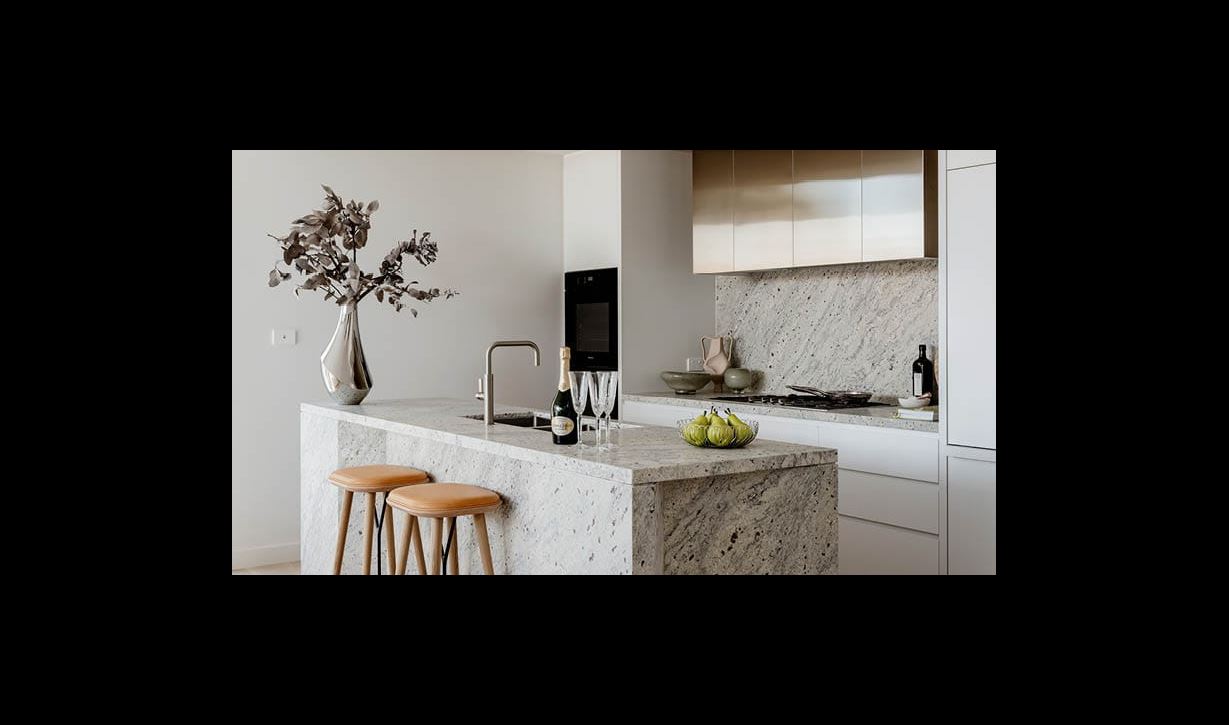

Video: Kitchen Styling with Steve Cordony

Mirvac has collaborated with Steve Cordony to show you how to make your home your haven.

News and Media

Building better communities: Mirvac's Commitment to Giving Back

Each year we hold a National Community Day where our employees bring their energy – and their paint brushes and gloves - to lend-a-hand to local commu...

Major International Art Festival, The 24th Biennale of Sydney, Ten Thousand Suns, Now Open

As proud principal partner, Mirvac is honoured to have been part of the exciting journey leading up to the launch of the 24th Biennale of Sydney, titl...

Mirvac and Suncorp join Brisbane City Council to unveil Brisbane CBD’s first sport courts

Mirvac, M&G Real Estate and Suncorp have completed works on a new community sport facility on the corner of Roma and Turbot Streets, the result of a $...

Partnering with Climate Leaders on Carbon Reduction

As a founding member of the Australian Climate Leaders Coalition (CLC), Mirvac has contributed to a new report which provides insights and practical e...

Latest social posts

Mirvac acknowledges Aboriginal and Torres Strait Islander peoples as the Traditional Owners of the lands and waters of Australia, and we offer our respect to their Elders past and present.

Artwork: ‘Reimagining Country’, created by Riki Salam (Mualgal, Kaurareg, Kuku Yalanji) of We are 27 Creative.